A Coaching Tip from Your Region!

Hello SW Region Leaders and Associates,

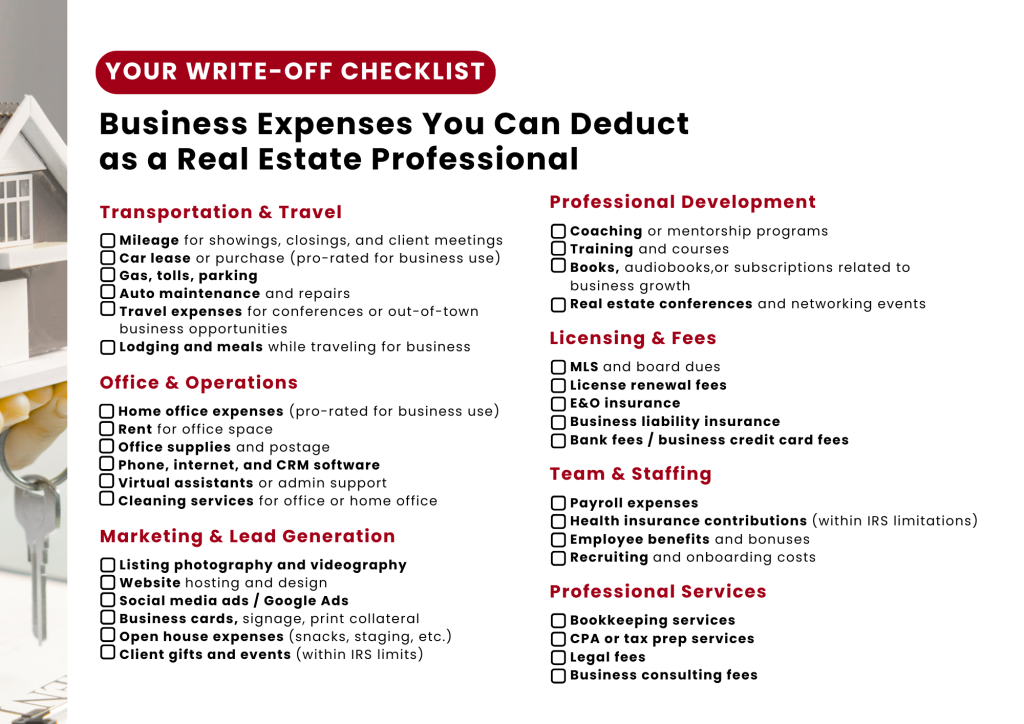

The right tax strategy is a business growth strategy. You’ve worked hard to build a thriving real estate business—don’t leave money on the table come tax season.

Many agents miss out on legitimate deductions simply because no one ever gave them a clear, real-estate-specific list of what can be written off. That ends today.

We’ve created a downloadable Write-Off Checklist for Real Estate Agents, inspired by Alchemy of Money, so you can easily track expenses and save more of what you earn.

Bonus: Smart Year-End Moves to Cut Your 2025 Tax Bill

(These aren’t write-offs—they’re power moves!)

Prepay Expenses – Pay for software, rent, or coaching before Dec 31 to lock in deductions now.

Review Your Mileage Log – Make sure every showing, closing, and inspection is tracked (apps like MileIQ help!).

Upgrade Your Tech Stack – A new phone, laptop, or camera = business tools that also reduce your tax bill.

Invest in Professional Services – Strengthen your bookkeeping or get tax strategy support before year-end.

Disclaimer

This information is for educational purposes only and does not constitute financial or tax advice. Please consult your accountant or tax preparer for guidance specific to your business.